Simple ira employer match calculator

That match may offer a 100 return on your money depending on the 401k. However these plans also offer business owners a way to avoid.

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Savings Incentive Match Plan for Employee SIMPLE IRAs are mainly designed for small businesses with 100 or fewer employees as the administrative costs associated with a SIMPLE IRA.

. Investing can sound intimidating but you dont have to do it alone. The SIMPLE IRA contribution limit is 14000 for 2022 with a catch-up contribution limit of 3000. Or 2 of a nonelective contribution employees may contribute but are not required to receive employer mandated contribution.

Maximize Employer 401k Match Calculator. However a rollover from a SIMPLE IRA to a non-SIMPLE IRA can be made tax free only after a 2-year participation in the SIMPLE IRA plan. The last output that the SIMPLE IRA calculator above supplies is a projection of how much your SIMPLE IRA account will grow over five years.

What are my Stretch IRA distributions. What is the impact of borrowing from my retirement plan. A SIMPLE IRA is a retirement plan for small businesses that offers your employees a salary-deferral contribution feature along with a matching employer contribution.

It is also possible to roll over a 401k to an IRA or another employers plan. If your employer offers a 401k match and you contribute to a Roth 401k you are still eligible to receive the match. The exact date at which RMDs are required is April 1st of the year after a retiree reaches the age of 72.

The two types of SIMPLE plans are the SIMPLE IRA plan and the SIMPLE 401k plan. Ebook ou e-book aussi connu sous les noms de livre électronique et de livrel est un livre édité et diffusé en version numérique disponible sous la forme de fichiers qui peuvent être téléchargés et stockés pour être lus sur un écran 1 2 ordinateur personnel téléphone portable liseuse tablette tactile sur une plage braille un. A Savings Incentive Match Plan for Employees SIMPLE IRA allows you and your employer to contribute to your retirement savings.

72t early distribution analysis. Net unrealized appreciation NUA vs. The SEP-IRA limit in 2022 is 25 of an employees salary or up to 61000 whichever is less.

The contribution limits of a SIMPLE IRA vs. Heres how you can reach your 15 goal by following that formula. Under a SIMPLE plan em-ployees can choose to make salary reduction contributions rather than receiving these amounts as part of their regular pay.

In order to. You will be required to provide your Employers SIMPLE IRA Group ID during the Account. In addition you will contribute matching or nonelective con-tributions.

How do I maximize my employer 401k match. If youre regularly investing in your employer-sponsored. Two of the most popular are the SEP IRA and the SIMPLE IRA both of which offer many of the major tax advantages of a regular IRA.

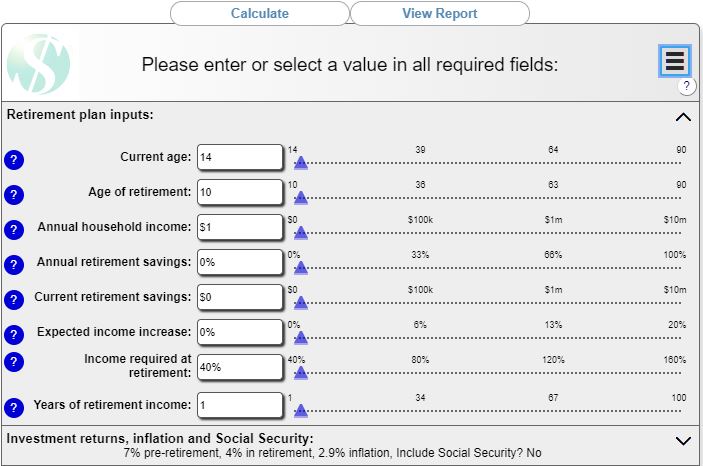

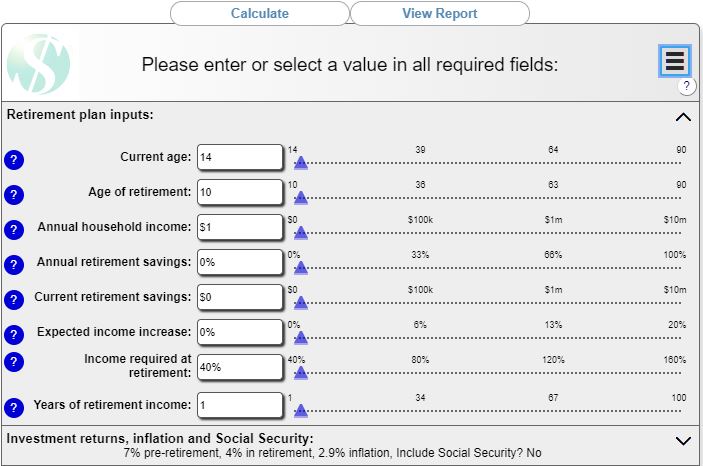

Yours employer match catch-up an estimate for return on investment and the number of years until retirement then click the Calculate button. Thats free money and a 100 return on. First if your employer matches contributions to your 401k 403b or TSP invest up to the match.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Generally you or your employee must begin to receive distributions from a SIMPLE IRA by April 1 of the first year after the calendar year in which you or your employee reaches age 72 if age 70½ was attained. This projection is based on five years of the same annual contributions and the same employer matching along with an annual return of 5 percent.

SEP-IRA are different too. When youre trying to figure out where to invest for retirement first just remember. For 2021 the SIMPLE IRA contribution limits are 13500 or 16500 for people who are age 50 and older.

To be eligible for a SIMPLE IRA an employee must have received at least 5000 in compensation in the previous two calendar. SIMPLE IRA Basics. Get 247 customer support help when you place a homework help service order with us.

You live in a mid-sized city lets say Tulsa Oklahoma where you earn 45000 per year. Roth IRA calculator. Consider a SIMPLE IRA if your small business has steady income and your employees want to make contributions to a retirement plan.

Workers over 50 can contribute up to 17000. A Savings Investment Match Plan for Employees SIMPLE IRA is an easy and low-cost way to set up a retirement program for self-employed individuals and small businesses with 100 or fewer employees. If your employer offers a 401k with a company match.

Im self-employed how much can I contribute to a retirement plan. Consider putting enough money in your 401k to get the maximum match. Match beats Roth beats Traditional.

No taxes will be imposed on rollovers. You currently have 5000 in your savings account and by saving 100 per month you manage to put another 5000 in your 401k. A SIMPLE IRA is a type of traditional IRA that is designed for small businesses with 100 or fewer employees.

SIMPLE IRAs A Savings Incentive Match Plan for Employees allows for employers with 100 or fewer employees to contribute to a traditional IRA account of their employee and match up to 3 of total compensation. And their employer can then match those contributions up to 3 of. Your employer has promised to match 100 of your contributions to the retirement savings account up to 5 of your total income.

Find your match. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The employer output for the SIMPLE IRA calculator above is.

Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs. SIMPLE IRA is an acronym for savings incentive match plan for employees individual retirement accounts. SIMPLE and SEP IRAs have similar rules imposed by the IRS.

Employee contribution limits for a SIMPLE IRA in 2022 are 14000 per year for those under age 50. The contributions your employer makes to your SIMPLE IRA become your property when they are invested in your. A SIMPLE IRA is a retirement account option offered by small businesses with 100 employees or less.

529 State Tax Calculator Learning Quest 529 Plan. People age 50 and older can make an additional 3000 catch-up contribution. What is the impact of early withdrawal from my 401k.

This simple 401k savings calculator estimates your retirement investment growth and explains why. For 2022 the SIMPLE IRA contribution limits rise to 14000 or 17000 for people 50 or older. Le livre numérique en anglais.

What Is The Best Roth Ira Calculator District Capital Management

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

Pin On Quick Saves

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Retirement Calculator Sams Investment Strategies

Download Traditional Ira Calculator Excel Template Exceldatapro

Free Simple Ira Calculator Contribution Limits

Ira Calculator See What You Ll Have Saved Dqydj

Free 401k Calculator For Excel Calculate Your 401k Savings

How Simple Ira Matching Works Youtube

Download Traditional Ira Calculator Excel Template Exceldatapro

Customizable 401k Calculator And Retirement Analysis Template

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro